Ca Real Estate Withholding Guidelines . What is real estate withholding? — real estate withholding guidelines. Go to ftb.ca.gov and search for withholding. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. Real estate withholding is a prepayment of california. An alternative withholding amount can be computed by completing. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. The standard withholding amount is 3.33% of the sale price. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form.

from www.templateroller.com

real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. The standard withholding amount is 3.33% of the sale price. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. Real estate withholding is a prepayment of california. An alternative withholding amount can be computed by completing. Go to ftb.ca.gov and search for withholding. What is real estate withholding? if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. — real estate withholding guidelines.

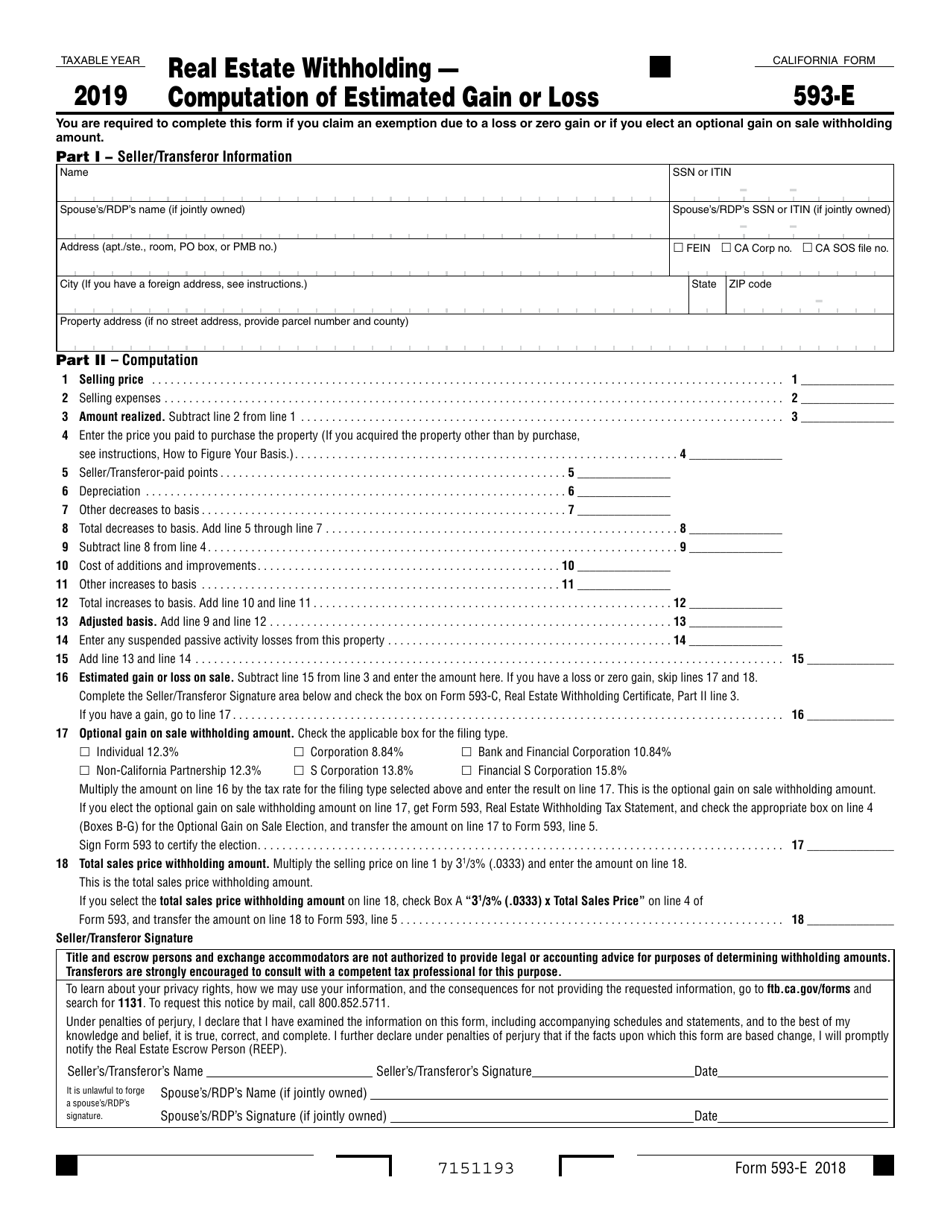

Form 593E Download Fillable PDF or Fill Online Real Estate Withholding Computation of

Ca Real Estate Withholding Guidelines if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. The standard withholding amount is 3.33% of the sale price. An alternative withholding amount can be computed by completing. Real estate withholding is a prepayment of california. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. Go to ftb.ca.gov and search for withholding. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. — real estate withholding guidelines. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. What is real estate withholding?

From www.formsbank.com

Fillable California Form 593C Real Estate Withholding Certificate 2005 printable pdf download Ca Real Estate Withholding Guidelines What is real estate withholding? Real estate withholding is a prepayment of california. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. Go to ftb.ca.gov and search for withholding. — real estate withholding guidelines. real estate withholding is required on the sale of. Ca Real Estate Withholding Guidelines.

From www.slideshare.net

California Changes 3.3333 Mandatory Withholding Requirement On Sale Of Real Estate Ca Real Estate Withholding Guidelines The standard withholding amount is 3.33% of the sale price. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. What is real estate withholding? — real estate withholding guidelines. An alternative withholding amount can be computed by completing. Go to ftb.ca.gov and search for withholding. Real. Ca Real Estate Withholding Guidelines.

From www.formsbank.com

Fillable California Form 593 Real Estate Withholding Tax Statement 2016 printable pdf download Ca Real Estate Withholding Guidelines An alternative withholding amount can be computed by completing. What is real estate withholding? The standard withholding amount is 3.33% of the sale price. — real estate withholding guidelines. Real estate withholding is a prepayment of california. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify. Ca Real Estate Withholding Guidelines.

From www.templateroller.com

Form 593V 2018 Fill Out, Sign Online and Download Printable PDF, California Templateroller Ca Real Estate Withholding Guidelines The standard withholding amount is 3.33% of the sale price. What is real estate withholding? — real estate withholding guidelines. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. An alternative withholding amount can be computed by completing. if you are a seller,. Ca Real Estate Withholding Guidelines.

From www.templateroller.com

Form 593 Download Fillable PDF or Fill Online Real Estate Withholding Statement 2022 Ca Real Estate Withholding Guidelines if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. Real estate withholding is a prepayment of california. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. An alternative withholding amount can be. Ca Real Estate Withholding Guidelines.

From www.pdffiller.com

Fillable Online Withholding CertificatesInternal Revenue ServiceWhat Is A Real Estate Ca Real Estate Withholding Guidelines if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. What is real estate withholding? — real estate withholding guidelines. An alternative withholding. Ca Real Estate Withholding Guidelines.

From www.formsbank.com

California Form 593E Draft Real Estate Withholding Computation Of Estimated Gain Or Loss Ca Real Estate Withholding Guidelines — real estate withholding guidelines. An alternative withholding amount can be computed by completing. The standard withholding amount is 3.33% of the sale price. Go to ftb.ca.gov and search for withholding. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. Real estate withholding is. Ca Real Estate Withholding Guidelines.

From www.formsbank.com

California Form 593E Draft Real Estate Withholding Computation Of Estimated Gain Or Loss Ca Real Estate Withholding Guidelines if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. — real estate withholding guidelines. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. The standard withholding amount is 3.33% of the. Ca Real Estate Withholding Guidelines.

From www.pinterest.com

New Post What is the 593 Real Estate Withholding Statement that is required when California Ca Real Estate Withholding Guidelines real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. The standard withholding amount is 3.33% of the sale price. Real estate withholding is a prepayment of california. An alternative withholding amount can be computed by completing. — real estate withholding guidelines. Go to ftb.ca.gov. Ca Real Estate Withholding Guidelines.

From www.pdffiller.com

Fillable Online ftb ca FTB Publication 1016 Real Estate Withholding Guidelines. FTB Publication Ca Real Estate Withholding Guidelines Go to ftb.ca.gov and search for withholding. An alternative withholding amount can be computed by completing. What is real estate withholding? The standard withholding amount is 3.33% of the sale price. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. if you are a seller, buyer,. Ca Real Estate Withholding Guidelines.

From www.formsbank.com

Fillable California Form 593I Real Estate Withholding Installment Sale Acknowledgement 2013 Ca Real Estate Withholding Guidelines — real estate withholding guidelines. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. The standard withholding amount is 3.33%. Ca Real Estate Withholding Guidelines.

From www.templateroller.com

Form 593 Download Fillable PDF or Fill Online Real Estate Withholding Statement 2022 Ca Real Estate Withholding Guidelines An alternative withholding amount can be computed by completing. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. Go to ftb.ca.gov and search for withholding. Real estate withholding is a prepayment of california. The standard withholding amount is 3.33% of the sale price. if. Ca Real Estate Withholding Guidelines.

From www.youtube.com

California Real Estate Withholding Tax How Can You Avoid It? YouTube Ca Real Estate Withholding Guidelines Go to ftb.ca.gov and search for withholding. The standard withholding amount is 3.33% of the sale price. What is real estate withholding? if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. Real estate withholding is a prepayment of california. An alternative withholding amount can be. Ca Real Estate Withholding Guidelines.

From www.formsbank.com

California Form 593C Real Estate Withholding Certificate 2014 printable pdf download Ca Real Estate Withholding Guidelines if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. Real estate withholding is a prepayment of california. Go to ftb.ca.gov and. Ca Real Estate Withholding Guidelines.

From www.calproaccountants.com

California Real Estate Withholding — Cal Pro Accountants Ca Real Estate Withholding Guidelines if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), we created a quick reference guide,. The standard withholding amount is 3.33% of the sale price. — real estate withholding guidelines. Go to ftb.ca.gov and search for withholding. real estate withholding is required on the sale of ca real property held by. Ca Real Estate Withholding Guidelines.

From www.pdffiller.com

Fillable Online ftb ca Print and Reset Form Reset Form YEAR CALIFORNIA FORM 2004 Real Estate Ca Real Estate Withholding Guidelines if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. An alternative withholding amount can be computed by completing. — real. Ca Real Estate Withholding Guidelines.

From www.signnow.com

593 20232024 Form Fill Out and Sign Printable PDF Template airSlate SignNow Ca Real Estate Withholding Guidelines Go to ftb.ca.gov and search for withholding. real estate withholding is required on the sale of ca real property held by a trust unless the trust can qualify for an. What is real estate withholding? Real estate withholding is a prepayment of california. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi),. Ca Real Estate Withholding Guidelines.

From www.formsbank.com

Fillable California Form 593L Real Estate Withholding Computation Of Estimated Gain Or Loss Ca Real Estate Withholding Guidelines Go to ftb.ca.gov and search for withholding. Real estate withholding is a prepayment of california. if you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form. An alternative withholding amount can be computed by completing. The standard withholding amount is 3.33% of the sale price. real. Ca Real Estate Withholding Guidelines.